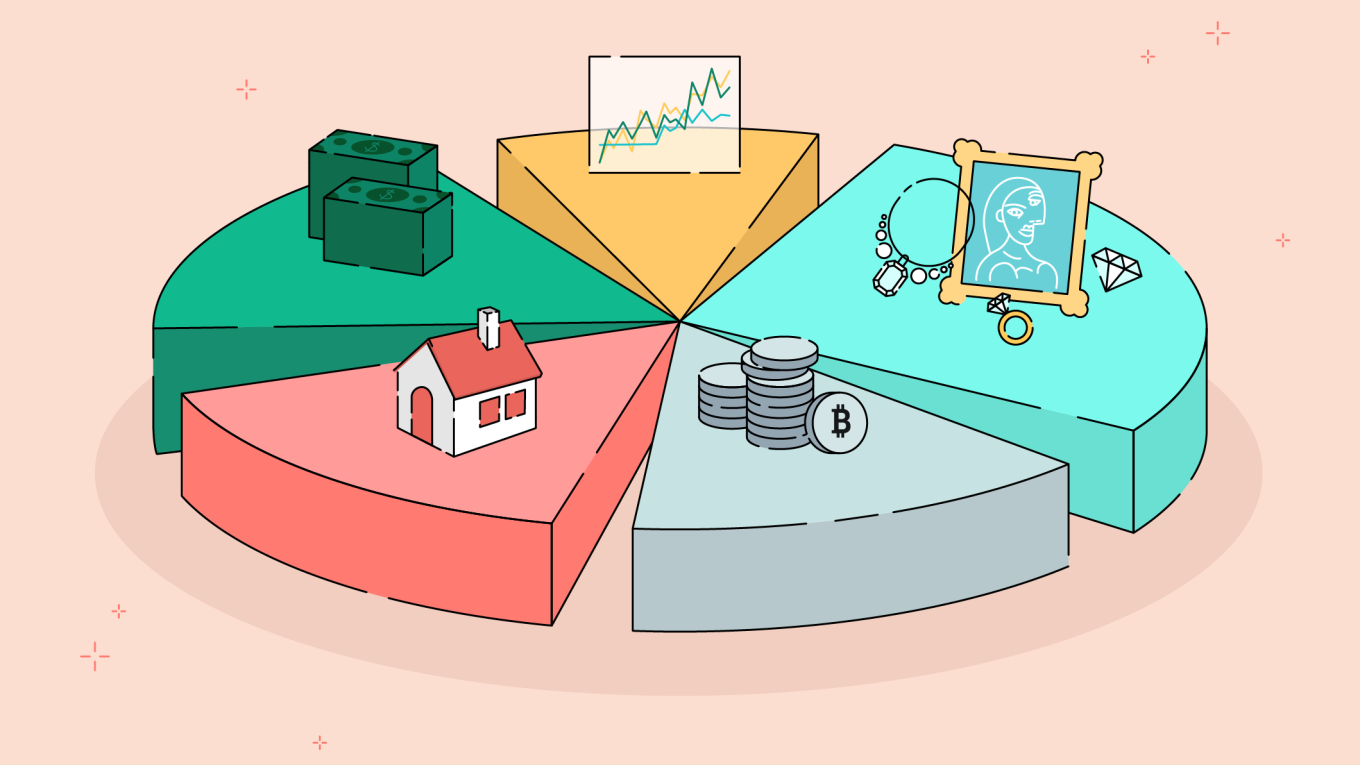

How Portfolio Diversification Can Benefit from Alternative Investments

In a long-term investing portfolio, alternative investments might provide some special advantages. Improved diversity, the possibility of better returns, non-traditional sources of portfolio income, and significant tax benefits are a few of these. Read more about investments here.

Alternative Investments Include:

- Private equity offerings

- Hedge fund offerings

- Real estate private placements

- Non-traded closed-end funds

- 1031 exchanges

- Exchange funds

- Non-traded business development companies

- Non-traded real estate investment trusts

- Managed futures funds

- Commodities

Despite the fact that cryptocurrencies are becoming more and more popular, it’s important to remember that they are not alternative investments and should be taken into account individually as part of a larger investment strategy.

Adding alternative assets to your portfolio may provide you access to new asset classes or investing strategies, depending on your existing asset mix and long-term objectives. Alternative investments could provide you access to non-conventional asset classes including hedge funds, private equity, private credit, and private real estate.

The Value of Diversifying Your Portfolio

Diversifying your holdings in a portfolio can help you reduce risk and guard against volatility. Alternatives might be a good option for diversifiers because they often show little to no link to regular equities and fixed income markets.

Increased Opportunities for Portfolio Growth and Income

The potential for alternative investments to increase portfolio returns is another reason why investors are interested in them. Alternative investments can assist investors in achieving growth or gaining access to sources of returns that are unrelated to the larger equities and bond markets by giving exposure to a diverse variety of assets.

However, it’s important to keep in mind that alternative investments are sometimes more complicated than regular assets and need for specialized understanding. You can better understand where return potential exists and whether alternative investments match your goals and risk tolerance by working with a financial adviser.

Deferred capital gains taxes and tax advantages

Capital gains taxes may be due after selling assets. Alternative investments may be able to lessen or postpone the effects of these obligations. Qualified opportunity zone funds, 1031 exchange funds, and exchange funds are three tax-advantaged options that may assist manage future capital gains tax liabilities, depending on the investment aim.

Other Things to Think About

- Alternative investments often involve constraints for investors and are long-term, illiquid investments.

- Numerous alternative investments are non-public offerings, which may have less openness regarding fees, investment kinds, and associated risks than regular registered securities.

- Complex trading or investing techniques, unconventional holdings, opportunistic tactics, leverage, and other factors are examples of alternative investments.